With the One Big Beautiful Bill, Iran, inflation and all of the other circus sideshows behind us, what will the next market catalyst be? The FED seems to be in no hurry, regardless of how badgered Powell is by Trump, to move off of rates. So what will it be? I am guessing the market is back to watching for trade deals and possibly TSLA. Remember when TSLA could tank or rally the market all on it’s own? With summer time trading in full swing something needs to happen or this could be boring AF.

We are still in a dip buyers market. When and where the dips will come is anyone’s guess. So just watch your levels and take the trade and manage the risk is all we can do.

APEX Trader Funding Coupon Link: 80% OFF Evals

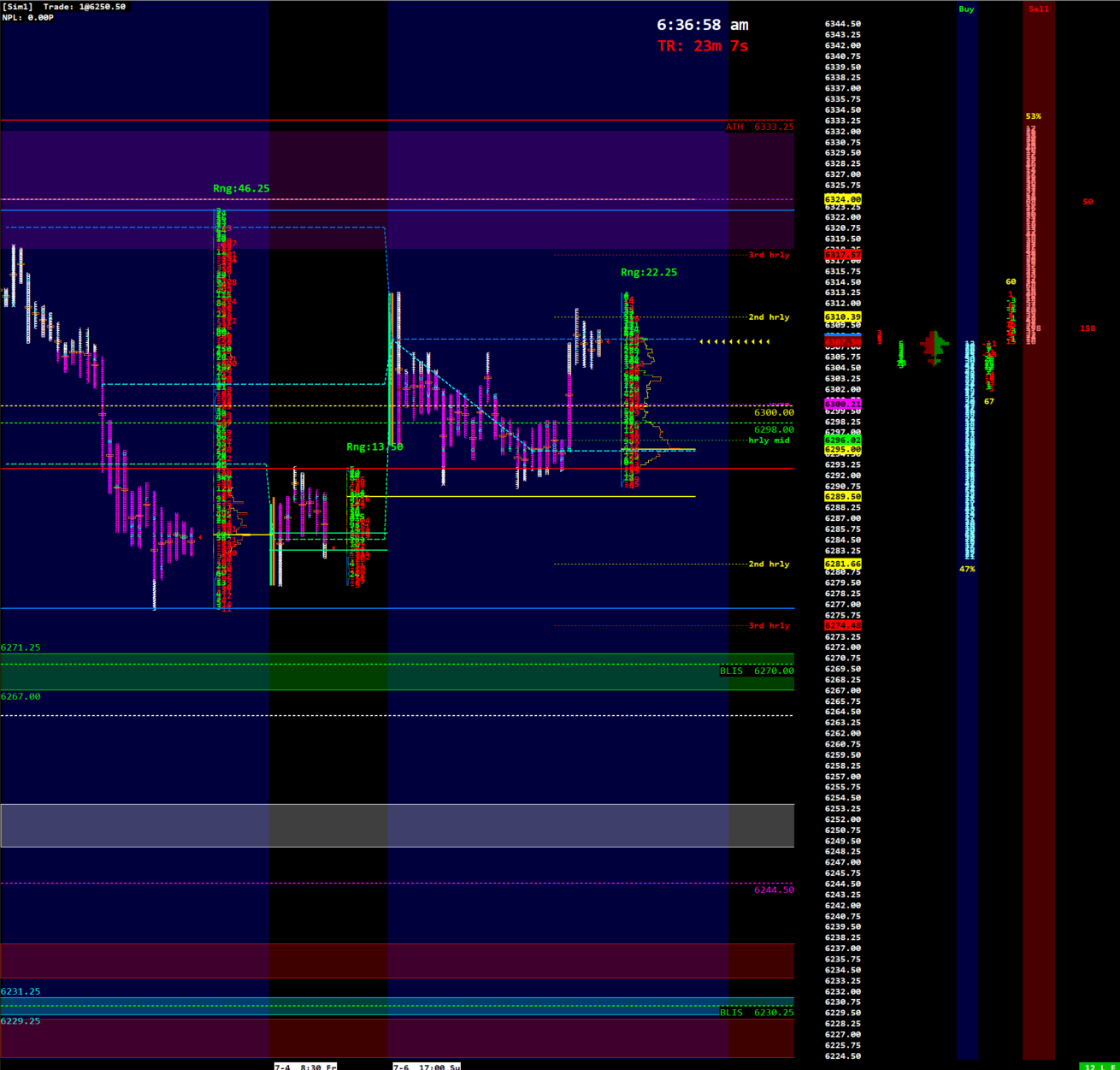

For ES I am watching for pullbacks into 6298, 6292.75 and finally 6270. A loss of 6270 could see a deeper pullback into 6230.25 and then 6200.

For NQ I have a SLIS at 22936. If we remain above this I think we test the ATHs. However, if offered beneath I want to see pullbacks into 22826, 22756 and 22389 BLIS supported.

Both the ES and NQ are up here on very weak structure. Volume is 27% below avg and getting worse as I type this. VIX is back above $17.50 which is not saying much. Mega caps not doing much and TSLA is getting smoked because Elon has not figured out that people are frowning on him being in politics. Yields are up as there is no reason for a flight to safety trade. CL is at $67. So outside of TSLA there seems to be no real risk in the markets. This week we have the 10 yr and 30 yr Bond auctions and Fed Minutes as potential news catalyst. The hourly bands are nice and tight so not seeing much risk of sustained sell if a pullback does happen.

So being a Monday after a holiday I am going to take it easy and let the markets setup. Patience and focus are key so I can get a good trade on, make some money and go do something else other than watch my screens.

Bish

Disclaimer: Educational and Entertainment Purposes Only

The information presented in this article is strictly for educational and entertainment purposes. It does not constitute financial advice, investment recommendations, or a solicitation to buy or sell any financial instruments. All content is provided "as is" without any representations or warranties.

Readers are advised that:

Trading involves significant financial risk

Past performance does not guarantee future results

Any strategies discussed are hypothetical and may not be suitable for all investors

You should consult a licensed financial advisor before making any investment decisions

The author and publisher are not responsible for any losses or damages arising from the use of this information.